Updated 5/19/2022

Review management is the gateway to profit.

You can use review management to sell various agency follow-up services — advertising, web development, design, copywriting, marketing, etc. It’s also a great standalone service if you’re simply looking to specialize.

Here’s the problem.

It’s not immediately clear whether you can afford to sell review management or not. You’ll need a variety of tools and resources to be successful, but you’ll also need to make sure that your pricing makes sense financially. Today I’ll show you how to sell review management profitably.

Want to see Grade.us in action?

Table of Contents

First, you’ll need to look at your delivery model.

What kind of review management service are you selling?

There are two areas you’ll need to look at to sell review management services profitably.

- Your agency’s delivery model

- Your agency’s business mode

When you’re selling review management services, these two areas have a significant impact on your profit. Let’s take a closer look at the two of these models.

Your delivery model

Your delivery model dictates agency growth.

Most agencies follow the managed services model; clients outsource their review management campaigns to their agency. In return, the agency improves the client’s reputation and its review portfolio, producing more conversions and revenue.

If you have the right delivery model, you should have:

- Consistent cash flow

- Financial predictability

- Data you can use to make accurate projections

- Systematic price increases

Let’s take a look at the delivery models available to agencies.

- Managed services: Clients hire you, your agency provides A to Z support covering the planning, execution, and improvements for their review management campaigns. This the most common delivery model, but it's also a tough sell if you're an unknown in the industry.

- Self-service: This is a do-it-yourself option that empowers clients (especially those with a lower budget) to help themselves via software, training or both. Agencies typically white label a software platform and resell their services on top of that.

- Managed to self-service: This option can be used in a variety of ways. One common approach is the development-to-hosting or development-to-campaign model. An agency builds a website, then they charge an ongoing fee for maintenance and hosting once the site is live. This model works with review management as well.

- Self-service to managed: This option is typically used as an upsell for skeptical clients who think they can handle things on their own or used as a loss leader so the agency can get their foot in the door with clients. With good onboarding and a healthy dose of reality, clients may realize they need more help than they originally anticipated.

- Managed + self-service: Your clients get to choose; they're able to choose managed, self-service, or any of the variations I've mentioned above. This helps you attract clients with large budgets and clients with tiny budgets who prefer a do-it-yourself approach, provided that they're profitable.

You’ll need to run the numbers regardless of the delivery model you choose.

These delivery models have caveats.

If you decide to choose the managed services model, your clients will depend on you for everything.

I mean everything.

If you’re full service, you’ll be expected to know the review platform forwards and backwards. You’ll be expected to respond to reviews on your client’s behalf. Many of your clients will expect you to have a deep knowledge of their business. Yes, this pays very, very well. It gives you the control you need to produce amazing results for your clients.

But, it’s a lot of work.

Do you really want to slog through a consistent stream of comments and complaints for your clients?

Be honest with yourself.

Here’s the other downside to this. With the managed services delivery model, clients are very dependent on you. Here’s the downside: you’re also dependent on them.

Why does that matter?

It means unreliable clients can force you into feast or famine whenever they feel like it. If they don’t feel like they need you (or they refuse to pay), you may have to lay off employees. If they suddenly need lots of additional support, you’ll need to hire quickly. This means you’ll need:

- A virtual bench of independent contractors and employees

- Strong and clearly defined agreements

- Reliable payment methods

- And (possibly) contract terms that renew automatically unless explicitly stated otherwise

Prefer to go the self-service route? This works well too. Create a strong marketing message that resonates with prospective clients, and you’ll attract a significant amount of self-service clientele.

Here’s the downside.

These clients aren’t especially loyal. Churn rates can be high, even if you do a fantastic job promoting your self-service option to needy clients.

Why?

Self-service depends entirely on your client’s ability. Your income is subject to their whims.

There’s danger here.

If clients give up, fail to produce the results they want, or can’t seem to find the answer to their problems, you lose money. If they become bored or simply lose interest for any reason, you lose money.

These clients are dangerous.

Many of these clients are do-it-yourselfers who are often short on cash or looking for creative ways to cut your agency out of their financial life. Some of these clients will look for ways to get more work from you than they can afford.

What does this mean?

You can never stop marketing. You’ll need to promote your self-service option to outpace client churn continually. Your churn rates and your marketing expenses will likely be higher.

The moral of the story?

There are pros and cons to every option, even if that means simply choosing to do nothing. If you decide with open eyes, you’re far more likely to weather the inevitable storms of the future.

Your business model

Alexander Osterwalder, author of the book Business Model Generation, states that the “business model describes the rationale of how an organization creates, delivers, and captures value.” There are many models your agency can adopt; we’ll take a look at a few of the more common models and go from there.

- Subscription: With a subscription, your agency bills a set monthly fee in exchange for services, whether they’re used by your clients fully or not. Your clients are typically paying for access to the service rather than the service itself.

The subscription model isn’t as popular for creative services, but it’s frequently used to sell marketing, hosting, or ad hoc services. It can be profitable provided that you’re fully aware of your breakeven cost ahead of time. If you’re not mindful of your expenses upfront, this can become a major problem if you price your subscription fees too low.

The last thing you want is to be locked into a subscription agreement where you lose money every month.

2. Pay-per-model: With this model, your client pays for the outcome or result. They pay for each lead, call, or demo that’s done. Often agencies reuse uniform content like landing pages, designs, and content to keep costs low.

This is the most profitable business model by far. It’s easier to sell clients on the pay-per-model because it’s aligned with their interests and results-oriented. If your agency doesn’t generate a conversion, clients don’t pay a dime. It’s a no-brainer for clients to spend $20 -$150 dollars per lead because it’s tied to a real person that’s interested in their product or service.

If you can make this model work, it’s a surefire way to build a seven, eight, and even nine-figure agency. The best part about this model is the fact that it’s scalable.

If you can generate a significant amount of leads using an existing landing page or ad campaign, there’s really no need to hire more employees. You can build a thriving and successful agency with a skeleton crew if need be.

3. Retainer: In the agency world, a retainer is treated as a subscription. In reality, it’s actually a rainy day fund. If clients pay you, but they don’t use your service for a particular month, they’re usually entitled to a refund or service.

This is the bread and butter model for most agencies. It’s one that agencies find the most comforting because they believe it means guaranteed income. This isn’t actually true. Clients are quick to simply stop paying if they feel they’re getting a bad deal, regardless of what your agreement says.

Many realize it’ll cost you more to take them to court for the billings than to simply let it slide or work with them, so they’re far more willing to take advantage. Agencies with weak policies and procedures will find this model, on its own, is difficult to work with over time.

4. Hourly billings: This is exactly what it sounds like. You bill clients by the hour for work that’s done. This is typically something established businesses go for.

Hourly billings are easy to sell — so long as you have the reputation and track record to back it up. If you don’t, you’ll need to build a significant amount of trust (via your sales team, agreements, policies, etc.) to provide clients with the peace of mind they need to agree to this. Agencies of a certain size will have no problems with this as this is standard operating procedure at that level.

5. Performance-based: Your agency receives a large sum and bonus if you’re able to hit your targets and produce specific results for clients. With this model, the agency assumes almost all of the risk.

This model is also a profitable one.

It puts agencies and clients on the same page. If you can achieve the outcomes, your client wants, your client rewards you with an enormous payday, bonus, or incentive to produce more of the same results. It’s a wonderful option to use in the right circumstances if you know what you’re doing.

That’s the problem, though.

Most agencies don’t know how to make this model work for them. It also doesn’t help that this typically requires a great deal of trust and transparency on both sides to work. If clients aren’t willing to share additional data with you and maintain transparency, this model won’t work.

6. Project/flat fee: Your clients pay you a flat fee to complete a specific project or task. Your profit is dependent on how fast you work. The quicker you work, the more profit you have leftover.

Many clients prefer this model as it provides them with a certain amount of predictability and control over their finances. This model can be incredibly profitable, provided that you’re aware of what it costs for your agency to offer your services.

This also means that you’ll need to have strong controls over common problems like scope creep and gold plating over the course of your project or service.

Note: If you’re not sure how to price out review management, you’ll want to download our free pricing guide.

Which one is best for your agency?

The one that generates the most revenue and the least amount of headaches for your business. For some agencies, a hybrid approach may work best (e.g., combining the pay-per model with flat fee or retainer services). For others, optimizing a single model will be best.

Testing is the best way for you to find out.

Why did we spend so much time on the business and delivery model?

These models affect profitability.

Agencies are adaptable; they’ll do what it takes to win a client. Let’s say they’ve run the numbers and found that their managed retainer model works financially; it’s profitable for their agency and the client.

That’s good news!

Agencies are often willing to change their business and delivery models on a whim if it means winning the clients. They do it because they want to keep their business going and pay their employees.

Here’s the problem.

The review management services agencies offer made financial sense when it followed the managed retainer model. As soon as you switch to the managed pay per lead model, you’re in the red. Changing the model changes profitability. This is why we’ve spent so much time focusing on business and delivery models.

What makes financial sense in one model may not make sense in another.

How to plan and make margins selling review management

The managed retainer model is the most common route for agencies to take, so we’ll focus our attention there for the purposes of this article. You can use the formulas I share with any of the models I’ve listed above. It’s supremely important that you run the numbers again if you decide to change models for a particular client.

First, you’ll need a list of your expenses.

If you’re selling review management services, you’ll want to make a list of the expenses required to service a single client. These expenses will be factored into our formulas later, so it’s important to get these figures right. Here’s a list of expense items that you’ll want to factor in if relevant.

- Business/office costs: Your rent, utilities, phone, and security expenses are all examples of office costs. Equipment costs, maintenance, and cleaning would also qualify as office costs.

- Employment costs: What it costs your agency to pay an employee to manage a client's review portfolio or reputation. This figure is typically employee costs = number of employees x their average monthly benefits package. For their benefits package, you'll want to factor in salary, insurance, taxes, training, 401k matching, etc.

- Production costs: This includes everything from licensing fees for software (i.e., white-labeled review management software), tools, training platforms, and tertiary or third-party costs (e.g., hosting, SSL, materials, and supplies).

- Professional costs: Corporate status or annual report documentation. Government tax and licensing fees, corporate filing fees, attorney and accountant fees, etc.

For each of these, you’ll want to determine fixed vs. variable costs. Calculating fixed costs is straightforward; just tally your expenses then add up the totals. Variable costs are expenses that change in proportion to your production output (i.e., Microsoft Office licensing fees increase as you hire more employees).

Many organizations have been forced to go remote due to the pandemic. This could be an opportunity to reduce or even eliminate certain expenses (i.e., business and office expenses). If you’re running a small agency, you may be able to go fully remote, eliminating the expenses that come with a lease — your lease, utilities, insurance, office cleaning, security, etc.

If you can’t go fully remote, you can still work to reduce expenses in these areas (e.g., utilities, cleaning, etc.).

What if you’re unsure?

Use this heuristic as a guide. When production increases, variable costs increase. When production decreases, variable costs decrease. If you’ve calculated your expenses and added up the totals (overall and for each segment), you’re ready to set your profit margins.

A word of caution: Choose your margins carefully.

Betterway CPAs list anything between 6 to 12 percent as a ‘good’ profit margin. According to agency trainer Jason Swenk, a profit margin of 32 percent or higher is the goal. When I ran my agency, a profit margin of 40 to 60 percent was routine for us.

You’ll need to determine this ahead of time.

If you know your expenses, you have what you need to set your margins carefully. You’ll also want to answer some questions for yourself, so you can’t be ambushed by a predatory client later on.

- What’s your walk-away figure? This is the lowest margin you’re willing to accept; anything lower and you pass on the deal. It’s a way to determine how much profit you’re willing to lose to win a new client. If you’re selling review management, you’ll want to choose this number ahead of time.

- Can your client segment support your profit margin? If you’re selling to cash-poor startups or struggling small business owners, but your profit margin is 50 percent, you may struggle to win new clients. On the other hand, if you’re selling to enterprises and your margin is 10 percent, you’re going to work yourself to death.

- Can you justify your profit margin? If your profit margin is high, your customers may ask questions. Why are you so expensive? Your competitors are cheaper, etc. It’s a good idea to be prepared with an answer that’s satisfying for clients and truthful for you. One of my answers alluded to the fact that we couldn’t continue to grow if our pricing was the same as our competitors. Our response was truthful, clear, and concise.

- What are your competitors offering? If you’re more expensive than your competitors, you’ll eventually need to explain why. That said, there’s a dollar amount that’s just above the limit of what your clients are willing to pay in a given market. It’s your job to identify that figure, then train your clients, so you’re able to move that figure.

For our example, we’ll use a profit margin of 25 percent.

Okay then.

We’ve made a list of our expenses, and we’ve determined our profit margin. Now it’s time to plug the numbers in so we can calculate our breakeven cost.

Calculating your review management breakeven cost

I’ll cover this briefly for those who are unfamiliar.

Your breakeven point is the place where your revenue is equal to your agency’s expenses. You’re not making money, you’re not losing money, you’re just surviving. You’ve paid your bills, but you have nothing left over. It’s still a dangerous place for your agency to be.

Here’s why you need it.

Your breakeven costs show you the absolute minimum amount you need to make each month to keep your doors open and your agency in the black. Anything above that and you’re making money. For our calculations today, we’re going to use the following formula.

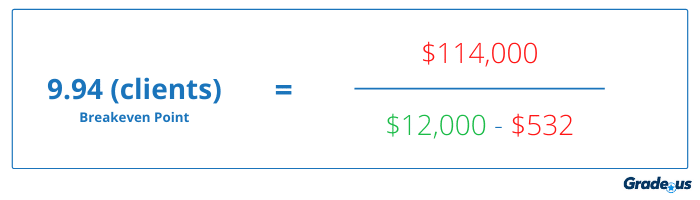

Let’s imagine that you have a rapidly growing boutique review management agency. You’ve tallied up your expenses, set your margins, and identified your variable costs. How would that work?

Let’s run the numbers.

Unless stated otherwise, these figures are annualized.

Fixed costs = $114,000

- -$94,000 two employees receiving a salary of $70,000 per year.

- -$20,000 for rent, utilities, insurance, and security.

Variable costs = $532

- -$1,000 spent annually for contract help on an as-needed basis.

- -$4,320 paid annually for the Grade.us, white-labeled, Agency plan.

With our agency plan we have 10 seats, so we divide our annual variable costs ($5,320) by 10 and our per unit variable costs come to $532.

SP =A $1,000 per mo. ($12,000 annually) retainer; $12,000 is the total amount earned from your client in a year.

Alright, let’s plug the numbers into our formula.

The total comes out to 9.94.

This means you will exceed your break even point at 10 clients, spending $1,000 per mo. Any upselling, add-ons, extra work that’s done is pure profit. Add your profit margin on top of the $1,000 per mo. ($250 in our example, and it brings your monthly retainers to $1,250.

And just like that, you’re turning a profit.

Even better, plans with Grade.us scale as you add more seats/users. The more people you add to your account, the cheaper Grade.us is for your business.

These numbers can be intimidating for many agency owners starting out. If you’re running your agency remotely, out of your house, your breakeven point will be much, much lower. If it’s just you, you’ll be able to grow using $500 per mo. retainers.

Start small if you want.

I’ve given you the formula here so you can play with the numbers. Here’s the important thing with this. Your expenses and your SP, they show you who to pursue in the market. If you’re looking to grow your business to seven figures, you’ll need to pursue different clients.

This shows you who and how to sell.

This formula provides you with precious information on who your target audience should be. This is how you sell review management profitably.

Here’s the incredible part about this.

If you’re able to upsell your clients, you can reduce the number of clients you need to make this work, while simultaneously increasing the revenue you bring in. If, for example, you upsell clients using a pay-per-lead model, you could bill them for each lead producing even more revenue for your agency.

Even better, clients with multiple locations provide you with huge upsell opportunities. In many cases, each location can function as another client entirely!

Just make sure you target the right industries.

Target the wrong industries, and profits may decline

In general, you’ll want to target industries with higher profit margins. If clients aren’t completely sold on the idea of review management, or their executives don’t know much about it, it could be a tough sell for low margin businesses.

Sageworks (now Abrigo) released data on the least/most profitable industries.

There are other profitable industries besides these.

Here’s the point.

People in low margin businesses will watch the spend and the returns like a hawk. These clients are far less likely to be loyal or trusting. If you have a bad month or something goes wrong, they’re likely to pull the contract.

Upfront research is key.

The more prepared you are going in, the easier it will be to attract, pitch, and win new clients. If you’re targeting an industry with higher margins and you come across an extremely price-conscious customer, the same rules apply.

With that in mind, here are a few tips you can use to pitch successfully.

- Contact several companies and ask them about industry profit margins, generally speaking. If they ask, let them know you're doing research.

- Get to know several influencers and decision-makers in your target industries. Be transparent, upfront, and clear about your intentions. Focus on building a value-driven relationship, not making a sale.

- Find ways to add value continually — provide them with press coverage, raise their profile by interviewing them, refer customers to their business, make introductions. Eventually, the value you provide will return to you.

Look for ways to add value, and prospective clients will jump at the chance to work with you when the time is right.

What about negotiation?

Some agencies choose to provide clients with transparent, upfront pricing, while other agencies choose to negotiate for the best price.

It’s a subjective call.

You’ll need to weigh the pros and cons then decide which approach is best for you. If you’re not sure, the good is, you can test both approaches to see what you’re most comfortable with.

Pros and cons of transparency vs. negotiation:

- Pro: Transparent pricing is easier to sell; it's also easier to disqualify clients who aren't a good fit.

- Con: With transparent pricing, your income is capped unless you choose to raise your prices. This could be difficult if clients give you pushback.

- Pro: With negotiated pricing, you're able to set your price at will. The price you offer to every client is different so there's no forced anchoring. You're able to move your agency up or down in the market on an as-needed basis. Your revenue is largely in your control.

- Con: Negotiated pricing is harder to sell. Clients will be hesitant to accept a price that's too high but less likely to tell you. This extends sales cycles, forcing you to uncover the real problem (price) before concluding the sale.

See what I mean?

This is an area where some upfront research via prospect feedback and competitor research would be a good idea.

You've won the client, what should you do next?

You’ve just won the contract. You’re in the hot seat.

Produce quick wins and amazing results, and your clients continue to work with you. Fail to deliver, and they pull the contract or, worse, demand a refund. If you’re unsure what to do once you’ve landed a new review management client, you’ll want to check out my posts.

- Your Review Management Agency Guide: The First 30 Days

- Your Review Management Agency Guide: The First 90 Days

Follow these steps, and you’re more likely to keep the clients you earn.

Focus your attention on results.

Tie everything you do to revenue or their KPIs somehow. Continually show clients that the work you’ve done has produced stellar results. Remind them when they begin to forget, don’t allow others to take credit for your hard work.

What about set up fees?

This makes the sale that much harder. Clients have to spend more money before they see any results. It’s something many clients are likely to resist. A 7-day free trial is a much better option because it provides clients with the quick wins I mentioned above.

Note: If you decide to go this route, just make sure that you have an extra Grade.us seat on hand for new clients to use during their free trial.

A better option?

Bundling your services, you can combine this with various agency services — creative, development, or promotional work. You can use one service to (partially) subsidize another. Doing this reduces the risk, and it’s also much easier to sell since clients have already said yes to you.

Review management services have a high-profit margin

But it all depends on your upfront work.

Review management is a gateway service that generates more revenue for your agency and more conversions and revenue for your clients. It’s a win/win all around.

There’s a catch, though.

You’ll need to be sure that you can afford to sell review management services in your agency. There are a variety of tools and resources you’ll need to be successful. You’ll need to target the right clients, set the right price, and deliver value consistently.

It’s not hard; it just requires some work.

Follow the formulas I’ve shared, and you’ll have a clear path to profit laid out in front of you. With a bit of preparation, you’ll have everything you need to sell review management profitably.