Can good accounting make you money?

Wouldn’t it be great if your accounting was a profit center rather than a cost center? Accounting for most companies is an essential function that doesn’t produce revenue but still costs money to operate.

What if you could use it to generate cash flow?

Today, we’re going to show you how to use your accounting data to generate 5-star reviews and increase revenue using the data from your QuickBooks account.

Why Accounting Needs Reputation Management

If we’re looking at the data, reputation management just makes sense. The stronger your company’s review management portfolio, the more revenue, and customers your company will bring in.

- Companies with at least 82 reviews earn 54 percent more revenue annually than their competitors

- Local businesses that improve their Google My Business profile's rating from a 3.5 to 3.7 stars see a conversion growth of 120 percent

- Brands that respond to just one review earn 4 percent more than average

- Businesses with low ratings (1 to 3-stars) on Google or TripAdvisor experience the largest loss of revenue

- Companies that don't respond to any of their reviews earn 9 percent less than companies that do

This shows reviews are great for the company, but why would this be something accounting needs?

It’s important for several reasons.

- These results show management the value of online reviews (if they’re not already aware)

- Accounting can provide leadership with data that will produce more reviews

- These reviews lead to more revenue

It seems to me that this helps to turn your accounting data into a profit center.

The question is, how?

How to Make Accounting Data Profitable

You’re sitting on a treasure trove of data. Most of the time, this data is untapped and unused by organizations. This data, when used appropriately, is a competitive advantage in disguise.

Sounds too good to be true, I know.

But it is.

This is because customers vote with their money, they self-identify. Your ideal customers spend a significant amount of money with you. They buy more products, spend more often, and spend more in each transaction. These customers are telling you, with their money, that they believe your company is something special.

This is huge.

If you know which behavioral markers to watch for, you can help management identify your best customers. Not speculating as sales and marketing would do, but with cold, hard, financial data.

Customer spending is an indicator of relationship status.

What kind of data do you need?

You’re looking for quantitative metrics that signal relationship status.

- Revenue per customer: This metric shows you which customers are willing to spend more money with your company. The higher the revenue, the more engaged and interested your customers are.

- Repeat sales (per customer): Research shows 67 percent of customers spend more in their third year of buying than their first six months. This suggests purchase volume and average order values increase over time.

- Purchase frequency: This metric is wonderful because it shows you who your engaged and loyal customers are. But it’s also valuable because it shows you which customers are losing interest, have lost interest, or are no longer interested. With this metric, you can show marketing which customers to target with their win-back efforts first, second, third, etc.

- Purchase immediacy: This metric answers the question, how soon do customers buy? According to Think with Google, immediacy trumps loyalty. This metric requires teamwork (with marketing) to identify the customers with the quickest ideal response (e.g., spending money). This is especially powerful when paired with revenue per customer as it helps to identify your super-spenders.

- Profit margin: The customers who buy your most profitable products or services are extraordinarily valuable. This is because customers attract people like themselves. The more reviews you receive from these high-value spenders, the easier it will be to attract customers just like them.

- Monthly, quarterly, annual spending: These metrics help you to identify trends. Do specific groups of customers buy at particular times? Does cash flow decrease at set times each quarter? This metric enables you to identify the hidden triggers driving purchase trends, which helps you adapt or shift these trends. Getting a review from a super-spender can draw in many eager customers interested in the same benefits you offer.

One thing that’s great about QuickBooks is the fact that they enable you to run custom reports. This means you can create these reports on an as-needed basis to share with those who need to know. Here’s a brief walkthrough showing you how to customize reports in QuickBooks.

Okay, you have the reports.

What are you supposed to do with them, and how will this lead to more revenue? You create a review management campaign, and you send out requests to your best customers first.

I don’t recommend doing this manually.

How to Automate Reputation Management Using QuickBooks

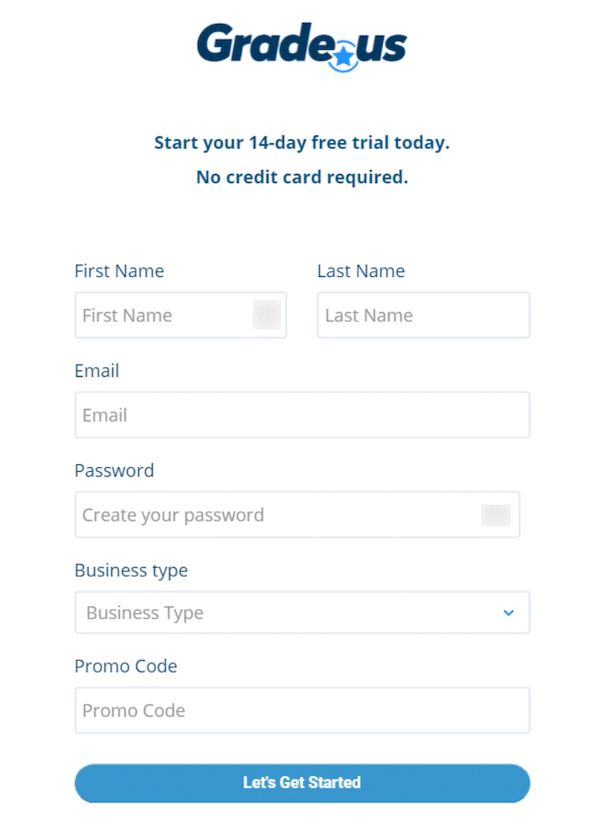

You’re going to need two things: a QuickBooks account and a Grade.us account. If you don’t have a QuickBooks account, you can sign up for a free trial and get step-by-step info to set up your account via the QuickBooks YouTube channel.

What about Grade.us?

If you don’t have a Grade.us account, or you’d like to take it for a test drive (no credit card required), you can get a free 14-day trial here.

All set? Perfect!

Let’s walk through the integration process together.

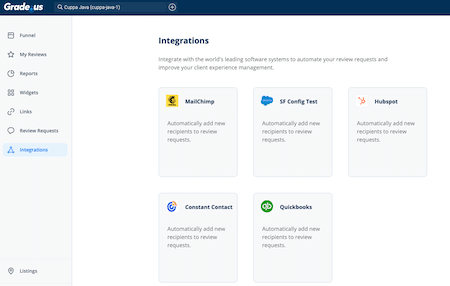

- Sign into your Grade.us account. In your desired account, click the “Integrations” tab on the left sidebar.

You should see QuickBooks in the list of integrations.

2. Select ” QuickBooks” as the application you want to integrate.

3. Click “Configure” to start the authorization process.

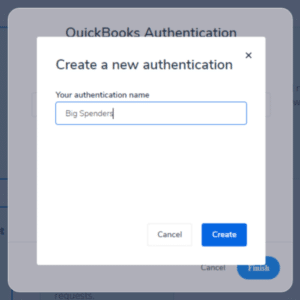

4. Click “New Authentication” to name your import, then click “Create.”

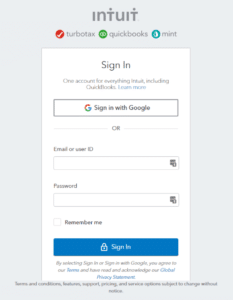

5. A new window will open, prompting you to sign in to your QuickBooks account.

If you don’t have an account, you’ll be able to create one as well.

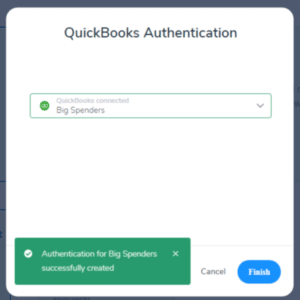

6. Once you’re signed in, you see a confirmation success message. Click “Finish” to complete the process.

From there, you should be able to trigger email and SMS review request campaigns using your QuickBooks data.

Here’s the wonderful thing about all of this.

When you create a custom report in QuickBooks (see metrics listed above), You’re able to personalize your review requests to each group specifically, increasing your odds of success with your review management campaigns. Here’s an example to show you what I mean.

- You run the Revenue per customer report

- You notice your best customers spend $5,000 or more annually with you

- You share the report with marketing and then create a review request template like this:

Hi [Name],

You really are amazing.

You’re one of our very best customers (top 1%). I wanted to thank you for your trust these past three years. I also wanted to ask you two questions.

- Are we making you happy?

- What can we change to make you happier?

Would you be willing to share your thoughts with us? If you are, you can do that here.

[review funnel link]

[Personal signature]

Can you see what’s happening?

The success rate of this email goes way up because it’s true. It’s backed by data. If your customers were to press you on it, you’d be able to break down why they were so great.

It’s a game changing shift many companies aren’t willing to make.

Accounting as a Profit-Center

Accounting can share the data with executives and management; they can share it with sales and marketing. Your organization can target profitable customers with laser-focused precision. Your financial data shows you who your best customers are.

Make them happier.

This decreases your marketing spend, increases top line revenue and gross profit, and prioritizes your growth investments.

Integrate QuickBooks and Grade.us, import your contacts, and you’ll be ready to reap the financial rewards. Share data across departments, and you’ll have what you need to boost marketing.

How do you use this to generate reviews?

It’s simple.

You create an email and SMS autoresponder sequence in Grade.us to reach out to each of your customers. Then you send review requests to each of these customer segments, one group at a time.

Here’s a detailed video walkthrough showing you how to set this up.

Setting these messages up is easy. What’s not easy is knowing who to ask or what to write in your email request. No worries, we’ve got you covered there too!

- 44 Unique Email Templates for Requesting Online Reviews

- 40 Situational SMS Templates for Requesting Reviews

- 11 Review Response Templates for Great Reviews

- 8 Review Response Templates for Negative Reviews

- How To Respond To Negative Reviews

- 60 Review Request Text Templates to Get Google Reviews

- 9 Industry-Specific Review Response Templates for Negative Reviews

Pick the right templates for your industry, customize them so they’re a fit for your business, then drop them into Grade.us. Select the duration and the number of messages you’d like to add, and you’re all set!

Combining Accounting and Reputation Management is a Win/Win

Good accounting should make you money.

Most companies view accounting as a profit center rather than a cost center; it’s an essential function that doesn’t produce revenue but still costs money to operate.

It doesn’t have to be that way.

With the right mindset, your accounting department can lead the charge towards increased revenue. Follow the steps I’ve laid out in this guide, and you’ll be able to use your accounting data to generate 5-star reviews and steadily increasing revenues using the data from your QuickBooks account.